In the modern world, time and the pace of life are so fast that it is vital in all areas to keep up with this pace in order to be able to continue functioning. If earlier you had to go to a specific store to buy the necessary item, now it is possible with the help of a computer and smartphone, and you can order the item you want from anywhere in the world. This led to the need to renew and modernise the means of payment.

Based on the pace of e-commerce development, you can unlock numerous benefits if you start to accept crypto payments on the website.

In this article, we will discuss the concept of e-commerce and Bitcoin and provide insights on how to adopt crypto as payment on your online store.

Key Takeaways

- Integrating Bitcoin payments into your e-commerce platform offers global reach, lower transaction fees, reduced risk of fraud, and faster transactions.

- Accepting digital currency can attract tech-savvy customers, enhance brand image, hedge against fiat currency volatility, and potentially lead to higher profits.

- Overcome challenges by understanding legal requirements, choosing reliable payment processors, educating customers, and implementing proactive security measures.

E-Commerce and Bitcoin: How Can Your Online Store Benefit?

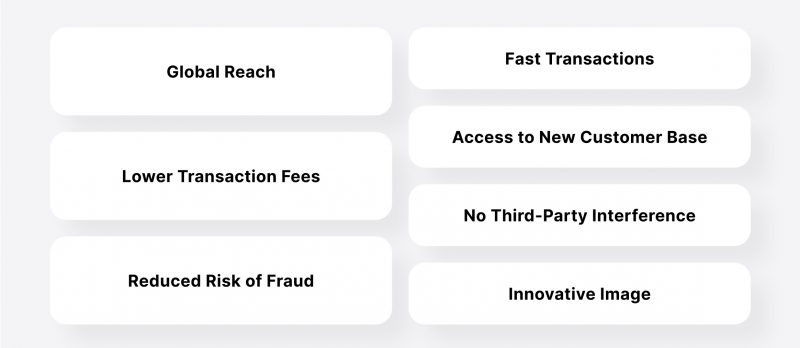

Accepting Bitcoin payments provides several advantages for businesses and individuals. Here are the outstanding benefits:

Global Reach

BTC operates on a decentralised network, allowing transactions to occur across borders without the need for traditional banking systems. This opens your business to a global customer base, increasing your market reach.

Decreased Transfer Fees

BTC transactions typically have lower transaction costs than traditional payment methods, especially for international payments. This can result in cost savings for businesses, particularly those with high-volume transactions or international customers.

Reduced Risks

Bitcoin transactions are irreversible and secure due to the blockchain technology they rely on. Once a transaction is confirmed on the network, it cannot be reversed, reducing merchants’ risk of chargebacks and fraudulent activities.

Fast Processing

Virtual currency transactions can be processed faster than traditional banking systems, especially for international transfers, which may take several days to clear. This speed can be beneficial for businesses requiring quick settlement of payments.

Access to New Customer Base

Accepting crypto payments on the website can attract a niche market of tech-savvy customers who prefer using digital coins for their transactions. By offering this payment option, you may appeal to a segment of customers who actively seek out businesses that support digital currency transfers.

No Third-Party Interference

BTC transactions are peer-to-peer and do not involve intermediaries like banks or payment processors. This means there’s no risk of frozen funds or accounts being restricted by third-party entities.

Innovative Image

Accepting digital payments can enhance your brand’s image as innovative and forward-thinking. It demonstrates your willingness to embrace new technologies and cater to the needs of modern consumers.

Hedge Against Fiat Currency Volatility

Some businesses view accepting crypto payments as a hedge against fiat currency volatility. By holding a portion of their revenue in BTC, they can potentially offset losses caused by fluctuations in traditional currency values.

Potential for Higher Profits

Bitcoin’s value has historically appreciated over time. Holding onto a portion of BTC received as payments could potentially lead to increased profits if its value continues to rise.

Supports Financial Inclusion

For individuals in regions with limited access to traditional banking services, BTC offers an alternative means of participating in the global economy. Accepting crypto payments can support financial inclusion by giving these individuals access to goods and services they otherwise wouldn’t have.

However, it’s essential to consider the potential risks and challenges associated with accepting crypto payments, such as price volatility, regulatory uncertainties, and integration complexities.

How to Accept Crypto Payments as a Business

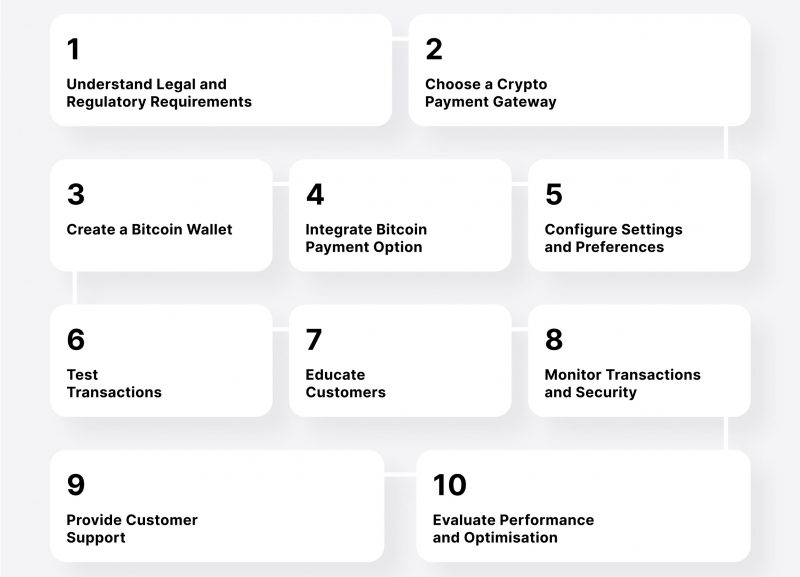

If you want to own a website that accepts Bitcoin as payment, you will need to go through several steps. Here’s a general outline of the process:

1. Research Legal and Regulatory Requirements

Before integrating crypto payments into your e-commerce platform, research your jurisdiction’s legal and regulatory requirements. Ensure compliance with relevant laws, regulations, and tax obligations related to crypto transactions.

2. Choose a Crypto Payment Gateway

Select a reliable payment processor or gateway to facilitate transactions on your e-commerce platform. Evaluate different providers based on factors such as transaction fees, supported currencies, security features, and integration options.

3. Create a BTC Wallet

Set up a secure Bitcoin wallet to receive and store payments from customers. Choose the best online Bitcoin wallet with robust security features, such as multi-signature authentication and cold storage options. You can use a hardware, software, or custodial wallet your chosen payment processor provides.

4. Integrate Virtual Currency Option

Integrate the BTC payment option into your e-commerce platform’s checkout process. Depending on your platform (e.g., Shopify, WooCommerce, Magento), this may involve installing a plugin or using the payment processor’s API to enable BTC transfers. Follow the integration instructions your chosen processor provides to ensure seamless integration.

5. Configure Settings and Preferences

Configure settings and preferences related to cryptocurrency payments within your e-commerce platform. This may include setting pricing in fiat currency and enabling automatic conversion of Bitcoin payments to fiat currency to mitigate price volatility. Customise confirmation messages and notifications to inform customers about options and transaction status.

6. Test Transactions

Before going live, conduct thorough testing of BTC payment functionality to ensure everything works correctly. Test various scenarios, including successful and failed payments, refunds, and order processing, to identify and address any issues or discrepancies.

7. Provide Learning Materials

Educate your customers about the option to pay with BTC and provide information on how to complete BTC transactions. Clearly communicate the benefits of using BTC as a payment method, such as faster processing times, lower fees, and enhanced privacy and security.

8. Monitor Transactions and Security

Regularly monitor BTC transfers and account activity to detect any suspicious or fraudulent behaviour. Implement security best practices to safeguard against unauthorised access to your Bitcoin wallet and e-commerce platform, such as strong passwords, two-factor authentication, and regular software updates.

9. Provide Assistance

Offer responsive customer support to assist customers with any questions or issues about accepting crypto payments. Provide clear instructions and troubleshooting guidance to help customers conduct the payment process effectively.

10. Evaluate Performance and Optimisation

Continuously evaluate the performance of BTC payments on your e-commerce platform, including transaction volumes, customer feedback, and conversion rates. Use this data to optimise your BTC payment strategy, refine the user experience, and drive greater adoption of Bitcoin payments over time.

By following these steps and implementing best practices, you can successfully integrate crypto transactions into your e-commerce platform and provide customers with a convenient and secure payment option.

Overstock.com was among the first stores to accept Bitcoins, as it was one of the first major retailers to integrate the world’s largest crypto as a form of payment.

Overcoming Common Concerns and Obstacles

To overcome common concerns and obstacles associated with accepting crypto payments, companies can take several proactive measures:

- Educate yourself and your team about how to accept crypto payments.

- Utilise secure payment processors or wallets.

- Manage price volatility.

- Ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations.

- Provide transparent pricing.

- Keep abreast of advancements in blockchain technology and payment processing solutions.

By addressing these concerns and implementing proactive measures, businesses can successfully overcome obstacles and use the benefits of accepting BTC payments.

Promoting Crypto Payments to Customers

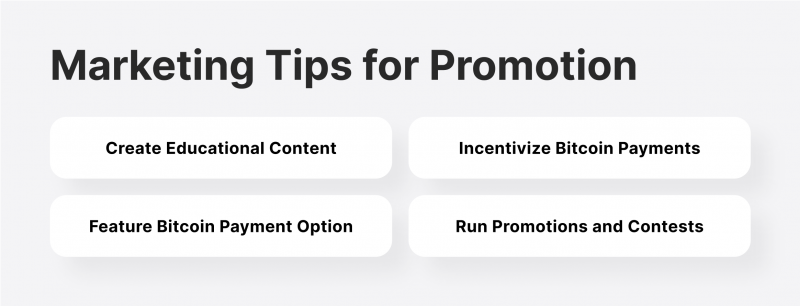

Promoting crypto payments to customers requires a strategic marketing approach to effectively communicate the benefits and advantages of using BTC as a payment method. Here are some marketing strategies to promote crypto payments to customers.

Highlight Benefits – Clearly communicate the benefits of using Bitcoin as a payment method, such as faster transactions, lower fees, enhanced security, and privacy. Create compelling messaging that emphasises these advantages and resonates with your target audience.

Create Educational Content – Develop educational content to educate customers about digital currency and how it works. This could include blog posts, articles, videos, infographics, and FAQs that explain the basics of BTC, how to make BTC payments, and the benefits of using crypto for e-commerce transactions.

Incentivise BTC Payments – Offer incentives and rewards to encourage customers to pay using Bitcoin for their purchases. This could include discounts, exclusive offers, loyalty rewards, or cash-back incentives for crypto payments. Highlight these incentives prominently on your website and marketing materials to attract attention and incentivise adoption.

Feature BTC Payment Option Prominently – Ensure that the cryptocurrency payment button is prominently featured on your website’s checkout page and payment methods list. Use visual cues, such as icons or badges, to draw attention to the Bitcoin payment option and make it easy for customers to select and use.

Run Promotions and Contests – Launch promotional campaigns and contests to generate excitement and drive the adoption of BTC payments. Offer prizes, giveaways, or discounts for customers who purchase using Bitcoin during a specific promotional period. Promote these campaigns through email marketing, social media, and other channels to attract participation.

By implementing these marketing strategies, you can effectively promote crypto payments to customers and encourage greater adoption of this payment method on your crypto e-commerce platform.

Conclusion

E-commerce and Bitcoin are getting closer, and stores globally are adopting BTC, as well as other leading altcoins, as payment solutions. While challenges and uncertainties remain, ongoing innovation and adoption efforts are expected to contribute to the continued growth and evolution of digital currencies as a dominant payment option on the global stage.